Today’s customers expect fast, frictionless payments. They don’t want to swipe a card, touch a terminal, or wait for a chip to load—they want to scan and go. That’s why more businesses and payment software providers are turning to QR Codes, which offer a simple, secure way to meet expectations and stay competitive in a digital-first market.

By using QR Codes for instant payments, businesses can speed up checkout times, reduce errors, and deliver a smoother, more reliable customer experience. A single scan can open a secure checkout page or connect to loyalty rewards, all while capturing engagement data behind the scenes.

From physical storefronts to mobile-first checkouts, QR Codes are making digital payments accessible for businesses across industries, and here’s how.

Note: The brands and examples discussed below were found during our online research for this article.

Why businesses need to modernize their payment systems with QR Codes

When speed, security, and convenience define the checkout experience, QR Codes are becoming a staple of modern payment systems. Especially in a post-pandemic landscape, where consumers are used to touch-free interactions, QR Codes serve as a flexible bridge between digital wallets and physical transactions.

For businesses, the appeal is clear: QR Codes are easy to implement and widely embraced by consumers. They eliminate the need for physical cards, reduce hardware costs, and integrate with mobile-first strategies. As demand for contactless payments continues to grow, QR Codes are an ideal tool for any business looking to stay ahead.

The rise of contactless payments in the digital age

The COVID-19 pandemic accelerated a global shift toward contactless payments, and the momentum hasn’t slowed. A recent report found that global contactless transactions reached $7.4 trillion in 2024 and are projected to grow 113% to $15.7 trillion by 2029.

As adoption scales, so do expectations, and consumers increasingly prefer fast, contactless options over traditional payment methods.

This shift in behavior isn’t just a passing trend. It’s the new standard. People are prioritizing safety, speed, and ease of use, while traditional methods like cash or card-based payments continue to fall behind. Mobile wallets, app-based checkouts, and QR Code-enabled systems are now the default for digital-savvy consumers.

For businesses, offering QR Code payments is a strategic move toward scalable, future-ready solutions. As consumers continue to favor mobile-first experiences, platforms must evolve to support flexible, secure payment options that meet people where they are—on their smartphones.

QR Codes vs. traditional payment tools: Why businesses are making the switch

For modern transactions, QR Codes check all the right boxes: speed, security, and simplicity. Compared to traditional options like magnetic stripe cards or near-field communication (NFC), QR Codes offer a flexible, lower-cost alternative that doesn’t rely on specialized hardware.

All it takes is a smartphone camera. Users scan the code to open the payment screen (via URL), enter or confirm payment details, and authorize the transaction. Here’s why QR Codes are becoming a must-have feature in today’s payment systems:

- Speed and convenience: QR Codes can link directly to your payment page or portal via URL, so customers can scan and pay in seconds without swiping, inserting, or tapping.

- Minimal hardware requirements: Businesses only need a way to display the QR Code, and customers just need a tablet or smartphone to scan it—no expensive point-of-sale (POS) terminals, card readers, or specialized scanners required.

- Increased customer satisfaction: In addition to delivering convenient self-service options, QR Codes can also help you offer a wider range of payment methods, such as PayPal and Apple Pay.

How QR Codes help support payment processing

QR Codes are scannable, two-dimensional barcodes that can link to a URL containing a secure payment record, such as an order number, transaction ID, or payment amount.

Businesses can create QR Codes that link to their own unique, secure payment pages, making it easier for customers to get transaction-specific details and make a payment for products or services via the linked URL. Customers scan the code to access the landing page, review the payment info, and confirm the transaction on that page, all within a few seconds.

Types of QR Codes used in payment systems

QR Codes come in two main types—Static and Dynamic—each with distinct use cases and advantages.

Static QR Codes link directly to a fixed URL and cannot be redirected or tracked. Because they don’t support updates, you have to reprint them every time you need to modify the destination, making them an unscalable solution for businesses that do a lot of transactions.

Dynamic QR Codes, on the other hand, offer far more flexibility. They contain a short URL that points to a backend server where the payment details are managed. If you’re using a paid Bitly plan, this setup allows you to track scans, gather analytics, and even update the destination URL without needing to generate a new code.

Here’s why Dynamic QR Codes are the preferred choice for payment systems:

- Real-time tracking of scans and user engagement

- Enhanced security through encryption and expiring links

- Editable payment details without changing the printed code

- Actionable data for insights and performance analytics

Step-by-step process of QR Code payments

Here’s what a typical QR Code payment journey looks like with Bitly:

- QR Code generation: A business uses Bitly to generate a Dynamic QR Code tied to a short link that directs customers to a personalized payment experience. Via an API connection with their point of sale terminal, it integrates the customer’s unique transaction details, such as amount, order ID, or table number.

- Customer scan: The customer scans the Bitly Code using their smartphone camera and taps the encoded link. Bitly ensures the link is fast-loading and secure (via HTTPS), and with a paid plan, you can use your own domain for a more cohesive and trustworthy experience.

- Payment review: The short link directs users to the payment interface page, such as Stripe, PayPal, Square, or a custom-built checkout. Transaction details are pre-filled via the API connection, so users can pay quickly and easily using their saved payment info or mobile wallet app.

- Transaction processing: The payment is processed through the merchant’s payment gateway. With a paid Bitly plan, Bitly Analytics can provide real-time visibility into link activity and QR Code scans, including location (city/country) and device type (iOS/Android), which is valuable for operations monitoring and marketing attribution.

- Confirmation and receipt: The customer receives an on-screen confirmation or digital receipt. Meanwhile, the merchant can use Bitly’s data to trigger post-payment flows using tools like Zapier, HubSpot, or Google Forms. They might redirect users to a thank-you page, a loyalty program sign-up, or a feedback form via URL.

The entire process is quick, secure, and user-friendly, typically completed in just a few seconds. And there’s no need to manually generate new codes for each transaction. Just set up your payment system to automatically create a unique payment link for every purchase, then you can use the Bitly API to update the short link destination.

Why businesses should integrate QR Codes into their payment software systems

QR Codes don’t just modernize the payment process. They help businesses work smarter by reducing friction, improving efficiency, and enhancing the customer experience.

Streamlining payment workflows with QR Codes

Speed matters in payments, especially in busy settings like retail, food service, or events. QR Codes for in-store payments simplify the entire process by removing the need for manual entry, card swipes, or clunky POS hardware.

Businesses are already using them to:

- Automate transactions at checkout or on invoices.

- Process orders faster, both in-person and online.

- Minimize human error at the point of sale.

- Cut down wait times and serve more customers more efficiently.

From table-side payments in restaurants to curbside pickups in retail, QR Codes help you keep operations moving and your customers satisfied.

Reducing payment friction and increasing conversion rates

Every extra step in a checkout flow creates an opportunity for drop-off. QR Codes reduce that friction by enabling fast, no-contact payments that are as intuitive as they are secure. This streamlined experience can help build trust and improve retention.

With a well-implemented QR Code payment system, businesses can:

- Simplify checkout with fewer steps and less friction.

- Improve both online and in-person purchase experience.

- Deliver faster service, leading to happier customers.

You can even take it a step further and use QR Codes to enhance customer service, enabling patrons to leave feedback, access support, or resolve issues quickly via a quick scan.

Enhanced security features with QR Code payments

Data privacy is a priority for businesses and consumers alike, and when paired with secure payment platforms like PayPal, Square, or Stripe, QR Code transactions can be tokenized to reduce vulnerabilities at every stage.

While Bitly QR Codes aren’t tokenized themselves, they are HTTPS-encrypted, ensuring that the data transmitted remains secure and protected from interception.

Via the Bitly API and the right payment software setup, businesses can automatically generate single-use codes for each transaction or redirect a single code to unique payment URLs. This can enable them to:

- Minimize the handling of credit and debit cards, potentially lowering physical security risks like card skimming.

- Keep sensitive payment details off exposed surfaces (like printed receipts or shared terminals.

- Ensure more secure transactions and protect customer data.

The growing role of QR Codes in the payment ecosystem

As consumers continue to prefer fast, touch-free transactions, QR Codes are becoming a core part of modern payment systems. Their simplicity, scalability, and low cost make them a smart solution for businesses of all sizes, from global retailers to local vendors.

Looking ahead, QR Codes are set to play an even greater role as digital wallets, mobile apps, and cloud-based payment platforms continue to grow. Their ability to bridge physical and digital experiences makes them a natural fit for the next generation of payments.

Forward-thinking businesses are adopting QR Code technology now to:

- Stay ahead of shifting consumer expectations and payment trends.

- Reduce hardware costs and simplify checkout.

- Build seamless, omnichannel payment flows that work in-store, online, or on the go.

- Create flexible, future-ready payment infrastructures.

Embedding QR Codes into payment strategies today is a smart way to drive long-term growth in an increasingly digital economy.

How real businesses are using QR Codes for payments

From major retailers to neighborhood cafés, businesses across industries are using QR Codes to create faster, safer, and more engaging payment experiences. These aren’t just convenience upgrades—they’re driving real business outcomes like shorter lines, higher conversion rates, and improved customer satisfaction.

Let’s explore how different industries are putting QR Code payments into action.

Retail and ecommerce: Simplifying in-store and online payments

In retail, QR Codes appear at checkout counters, on product packaging, and even in window displays, enabling contactless payments in just a few taps. By streamlining checkout and making payments more flexible, QR Codes improve customer experience in retail, creating faster, smoother interactions that reduce friction at the point of sale.

- Walmart uses QR Codes in its Walmart Pay system, letting shoppers scan at self-checkout and complete purchases through a streamlined mobile experience. Similarly, businesses can use Bitly Codes to drive customers to mobile-friendly, secure checkout pages via URL, speeding up transactions and reducing friction.

- Starbucks customers preload funds in the app and pay via QR Code, speeding up lines and earning loyalty rewards in the process. With Bitly, brands can use QR Codes to link directly to web-based payment flows or loyalty sign-ups, delivering fast, seamless experiences that keep customers engaged and coming back.

Restaurants and cafés: Enhancing the dining experience with QR Code payments

QR Code payments have become a staple in the food and beverage industry, from fast-casual to full-service dining environments.

- In-restaurant diners can scan QR Codes on tables to view digital menus and place orders, then pay via a unique code on their check—all without waiting for a server. This self-service model reduces staff workload, increases table turnover, and gives customers more control over their dining experience.

- Quick-service restaurants (QSRs) and food trucks are also adopting QR Codes to support self-service ordering, curbside pickup, and contactless payments, making the entire experience faster and more convenient.

Event ticketing and transportation: QR Codes for quick, secure access

Event organizers and transportation providers are using QR Codes to modernize how customers access venues, board transit, and pay fares. QR Codes eliminate the need for printed tickets or physical passes, creating a more seamless, secure experience from entry to exit.

- Event venues issue digital tickets with unique QR Codes that attendees or staff can scan at the door for entry. This helps reduce fraud (like ticket sharing), speeds up check-ins, and cuts paper waste.

- Concerts, sports arenas, and festivals use codes to simplify on-site purchases at food stands and merch tables, keeping lines moving and transactions fast.

- Airlines and ridesharing apps use QR Codes for mobile boarding passes and pickups, offering a seamless, touch-free travel experience.

Small businesses: Growing with QR Code payments

For small businesses, QR Codes offer an affordable way to accept digital payments and modernize the checkout experience without the cost of traditional POS systems. Via the step-by-step QR Code payment process we outlined earlier:

- Boutiques and pop-up vendors can use printed or digitally displayed codes to accept payments via Square, Venmo, PayPal, and other platforms. This gives customers a wider range of payment options and eliminates the need to lug around bulky hardware.

- Service-based businesses (like barbershops, personal trainers, and pet groomers) can add QR Codes to receipts and appointment reminders to streamline tipping and payment.

- After payment, businesses can redirect customers to confirmation landing pages that also feature loyalty program invitations or referral incentives, helping turn one-time customers into regulars.

The benefits of using trackable QR Codes with payment software

While QR Codes simplify payments for customers and businesses alike, don’t overlook the valuable data they can provide. With trackable Dynamic QR Codes, every scan becomes a source of insight, helping you better understand customer behavior, optimize performance, and make more informed decisions.

Unlocking data and insights with QR Code tracking

Dynamic QR Codes can come with built-in tracking that shows when, where, and how customers engage, helping you understand the customer journey and see how well your QR Code strategy is working.

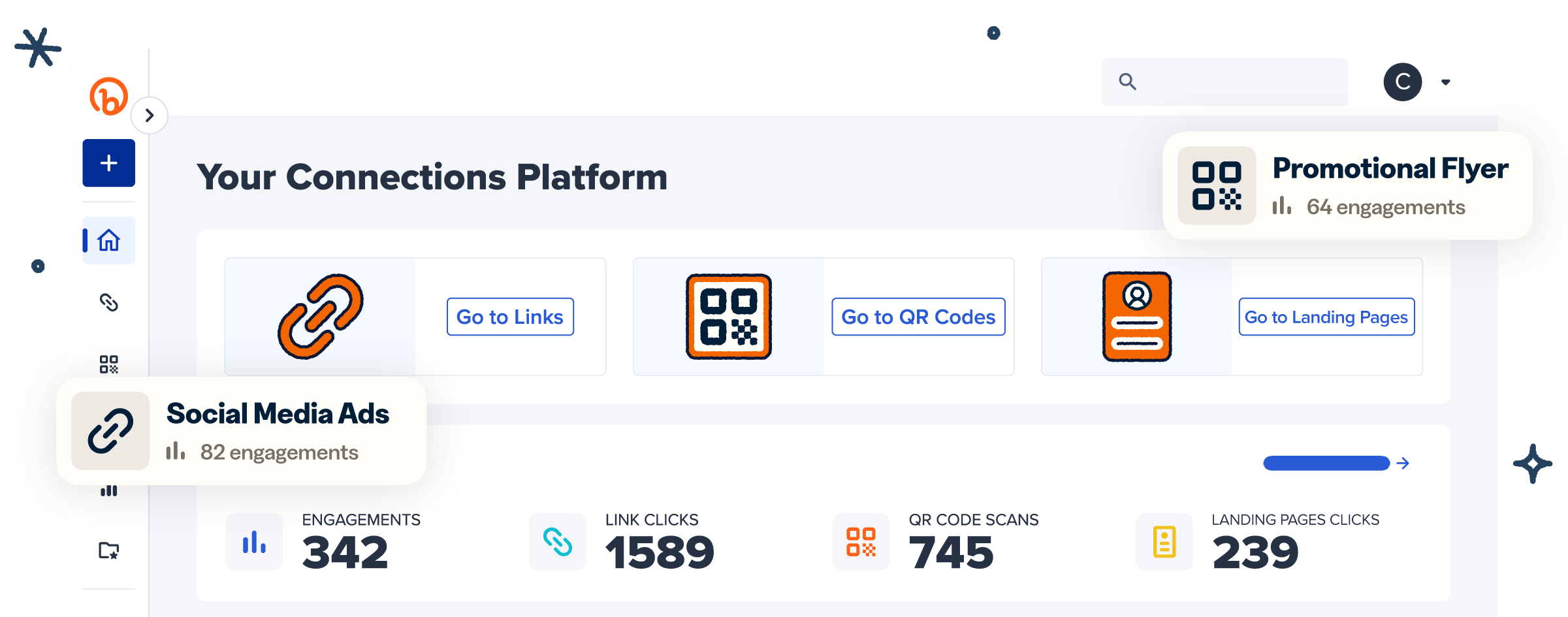

With Bitly Analytics (available with Bitly’s paid plans), you can:

- Monitor scans over time and use the data to inform staffing or resource planning.

- See which codes are driving the most engagement, helping you fine-tune messaging, placement, and overall strategy.

- Views scans by device, so you can tailor your destinations for the devices customers use most.

These insights turn payment interactions into growth opportunities. For instance, a coffee shop using QR Code tracking might notice a regular spike in scans on Mondays. With that information, the business could launch a targeted promotion, like discounted coffee at the start of the week, to boost engagement and drive more sales when interest is already high.

Optimizing payment systems through real-time analytics

While Bitly provides immediate insight into scan activity, location (city/country), and device type, it becomes even more powerful when used alongside tools like Google Analytics or a payment system’s native analytics platform.

Together, they offer a fuller picture of the payment journey, helping businesses identify drop-off points, optimize flow, and improve conversion. You can use them to:

- Spot delays or bottlenecks in the payment process and resolve them faster.

- Adapt promotions based on real-time scan trends, such as offering targeted discounts on days when engagement is highest.

- Refine payment methods by device type or location to boost conversion rates.

- Track offer performance and pivot campaigns in real time.

Say a business sees a high number of QR Code scans through Bitly Analytics but lower-than-expected conversions in Google Analytics. By pairing these data sources, they discover that most users are dropping off after landing on a slow-loading payment page. With that insight, they optimize the page speed, leading to faster checkouts and higher completion rates.

Addressing two of the most common concerns

As QR Code payments become more widespread, so do questions about their security. While they offer a convenient way to pay, some businesses and consumers remain understandably cautious about potential risks.

The good news is that most of these concerns can be mitigated with proper implementation, education, and the use of secure, trusted platforms.

Are QR Code payments secure?

QR Code payments can be highly secure when set up and managed correctly. Bitly has invested significantly in QR Code security to help protect customers and end users from threats like misuse, fraud, and data exposure.

All links within Bitly QR Codes are HTTPS-encrypted, which helps defend against interception and tampering during data transmission. It also makes it easier to spot a fake QR Code, since Bitly links always use HTTPS.

Unlike HTTP, which sends data in plain text, HTTPS encrypts payment details, so users can trust that the link hasn’t been tampered with and that their information will stay private.

To help prevent unauthorized access, Bitly supports two-factor authentication (2FA) and password protection for accounts, giving you more control over who can access or modify your QR Codes.

Bitly also takes user privacy seriously. Any data gathered from QR Code scans, such as location or number of scans, is anonymized by default. This means individuals scanning the code are never personally identifiable.

If suspicious activity is detected, Bitly offers a fast response path. Users can report potentially harmful QR Codes through a dedicated form, allowing Bitly’s Trust and Safety team to investigate and block malicious URLs quickly.

Do QR Codes protect customer data?

Unlike traditional payment methods that may expose card details at multiple points, QR Code payments reduce vulnerabilities by design. Here’s how they help protect sensitive information:

- End-to-end encryption: Data transmitted through Bitly QR Code payments is encrypted with HTTPS from the moment a transaction is initiated to the point it’s processed. This ensures that, even if intercepted, the data remains unreadable and secure.

- Threat detection: Bitly’s threat detection service scans all QR Codes and links created to identify threats. If abuse is detected, a notification is sent to Bitly’s Abuse API to mitigate the issues promptly.

- Minimal data exposure: QR Code payments minimize the risk of card skimming or shoulder surfing. Customers never hand over a physical card—everything is handled securely through their own mobile device.

Together, these features create a strong line of defense against fraud and data theft. For businesses, the key is choosing a reliable platform that supports secure QR Code creation and allows for safe, trackable usage.

Best practices for ensuring QR Code payment security

Securing QR Code payment systems doesn’t mean reinventing the wheel, but it does mean being proactive. The best way to build customer trust and prevent fraud is to implement smart, standard security measures from the ground up.

Follow these best practices to ensure QR Code payment security:

- Use a trusted and secure payment platform: Choose a QR Code solution from a reputable provider like Bitly that offers built-in encryption and Dynamic Code generation.

- Deploy only verified, branded QR Codes: Generic or unbranded codes are easier to spoof. Always use QR Codes that feature your logo, brand colors, and a clear call to action (CTA), which are all available with a Bitly paid plan. This increases customer trust and can help prevent fraudulent replacements.

- Monitor and regularly audit QR Code placements: Check public-facing QR Codes frequently—especially those displayed in-store, at events, or on printed materials—to ensure they haven’t been tampered with or replaced with malicious codes.

- Educate your staff and customers: Train employees to recognize the signs of QR Code tampering and ensure they understand basic security protocols. For customers, include brief messaging or prompts explaining how to verify that they’re scanning a legitimate code.

- Implement real-time monitoring and analytics: Track scan activity in Bitly Analytics, available with a paid plan, to detect any unusual patterns (such as sudden drops in scans from a single location) that might indicate fraudulent activity or misuse.

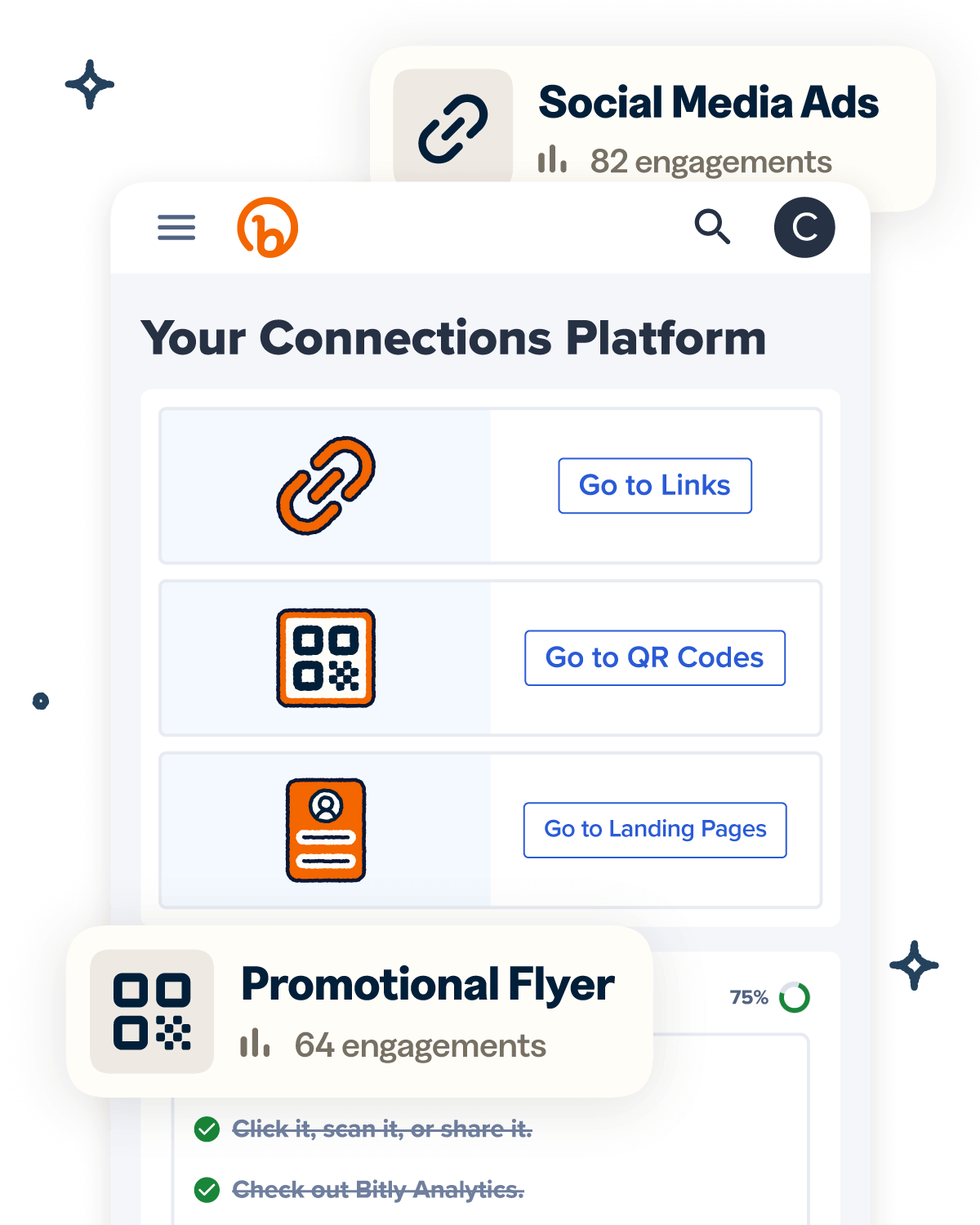

Modernize your payment experience with Bitly Codes

QR Codes have become a practical, proven tool for streamlining payments. From retail counters to restaurant tables, they simplify transactions, reduce hardware needs, and deliver the seamless experiences customers now expect.

Bitly makes it easy to put those benefits into action with secure Dynamic QR Codes and robust APIs that make it simple to create a streamlined, trustworthy payment experience. With Bitly, you can also track scan activity and tie it to customer behavior through connected tools like Google Analytics, helping you fine-tune your payment system for greater impact.

You can even customize each code to match your brand, boosting engagement and confidence, and create mobile-friendly Bitly Pages destinations for a cohesive, convenient experience end to end—all from one easy-to-use platform.

Explore Bitly’s plans and start leveraging branded, secure payment QR Codes that move your business forward.